Once defined by a singular focus on the United States, Colombia’s foreign policy is evolving to embrace China as a major economic and strategic partner. Growing trade, rising investment, and cooperation in health and infrastructure signal a broader recalibration of Colombia’s global engagement.

Historically, Colombia’s foreign policy has prioritised the principle of respice polum—looking to the North—given its strong alliance with the United States in areas such as trade, drug war, and peace building initiatives, among others, and has significantly limited Colombia’s engagement with other global partners. However, changes in geopolitics bring new opportunities to build relations with other partners and alliances.

Despite initial limitations, China and Colombia officially established diplomatic relations in 1980, recognising the “One China” policy. Since then, political engagement has gradually increased, with high-level visits focusing on trade, investment, and cultural and educational cooperation. According to Miranda, Chacón, and Montoya (2024), over the past ten years the two nations have held a total of 30 high-level meetings including discussions on trade, development, and cultural and technological alliances.

Between 2014 and 2022, Colombia–China relations grew significantly. Under President Santos (2014–2018), cooperation expanded beyond trade to include prisoner repatriation and infrastructure, with China donating recreational spaces in conflict-affected areas. During President Duque’s term (2018–2022), ties deepened further in public health, driven by COVID-19 vaccine diplomacy. This led to a partnership with Sinovac for vaccine production in Bogotá and joint disease prevention research, underscoring the strategic importance of the alliance. The partnership with Sinovac is a major milestone for Bogotá’s leading life sciences sector, highlighting strong bilateral trust through the successful use of Sinovac’s COVID-19 and hepatitis A vaccines. As Sinovac expands globally, the BogotáBio initiative may become a model for biopharmaceutical collaboration across the Global South.

Trends in trade and investment in the Sino Colombian relations

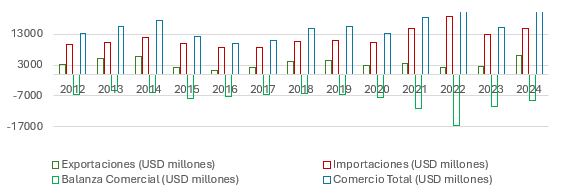

The trade relationship between Colombia and China from 2012 to 2024 shows a consistent and growing economic engagement, though one marked by a significant and persistent trade imbalance in favour of China. As shown in Graph 1, throughout the period, Colombian exports to China have remained relatively low compared to imports, with the trade deficit widening significantly in recent years. For example, while exports peaked at 6,232 million USD in 2024, imports were more than double at 14,768 million USD. This resulted in a negative trade balance of 8,536 million USD, slightly better than the record deficit of 16,545 million USD in 2022. The widening gap underscores Colombia’s continued dependency on Chinese goods and its limited export diversification toward that market.

Graph 1. Trade balance between Colombia and the People´s Republic of China 2012-2024

Source: Own elaboration based on trade data, several years

Despite the imbalance, the overall trade volume has increased substantially, reflecting deepening economic ties. Total trade grew from 13,165 million USD in 2012 to 21,000 million USD in 2024, showing China’s growing importance as a trading partner. The sharp increase in Colombian exports in 2024—a jump of nearly 190 percent from the previous year—suggests a potential shift, possibly driven by new trade agreements, rising commodity demand, or efforts to reduce the deficit. However, unless sustained and paired with broader export diversification, this uptick may only temporarily alleviate the structural trade imbalance that has defined Colombia’s commercial relationship with China over the past decade.

While Colombia was not a primary target, Trump’s protectionist trade agenda introduced volatility and concerns over long-term access to the US market. Notably, tariffs on steel and aluminium (25 percent and 10 percent respectively, under Section 232) applied to many countries, including Colombia, despite its preferential trade status. According to Triana, a relatively small portion of Colombian exports—around 17.3 precent—are significantly impacted by the added costs, based on findings from a study by the Colombian American Chamber of Commerce (AmCham Colombia). This organisation, which fosters trade ties between Colombia and the US does warn, however, that the tariffs should be removed as soon as possible. If left in place, they could lead to substantial economic consequences, including an estimated eight percent drop in exports to the United States. This would equate to a loss of 1.1 billion USD and could threaten up to 15,000 jobs.

The Chinese government is open to boosting Colombian exports, offering a chance to improve bilateral trade. However, Colombia’s productivity issues limit its role in global value chains. To compete globally, Colombia needs to modernise and invest in technology and industry—areas where collaboration with China could be key.

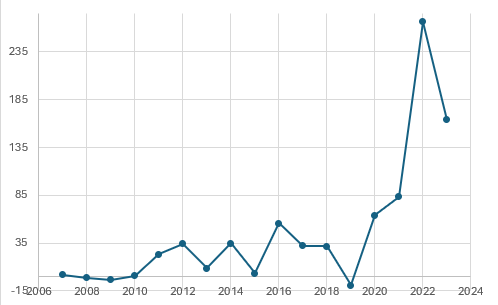

Graph 2. Foreign Direct Investment flows from the People’s Republic of China to Colombia, 2007–2023

Source: Own elaboration based on the National Bank FDI Statistics

Between 2007 and 2023, Chinese FDI in Colombia progressed from minimal and unstable levels to significant and sustained growth. Initial volatility gave way to more stable inflows around 2011, with a notable rise by 2016. A sharp capital outflow in 2019 signalled a temporary disruption, but from 2020 onward, investment surged. In 2022, Chinese FDI peaked at over 266 million USD, driven by strategic infrastructure projects, post-pandemic recovery, and strengthened bilateral ties. Though 2023 saw a slight dip to 163.9 million USD, investment levels remained historically high. Over the entire period, Chinese FDI totalled approximately 771.5 million USD, underscoring Colombia’s increasing importance in China’s regional economic strategy.

Infrastructure has become a central pillar of China–Colombia cooperation, with growing involvement from Chinese state-owned enterprises in major projects. Notably, the Bogotá Metro—built in part by China Harbour Engineering Company—represents a strategic entry into Colombia’s urban infrastructure. Chinese firms are also active in road and energy sectors, participating in initiatives like the Autopista al Mar 2 and exploring investments in electricity transmission and renewable energy. These efforts signal broader ambitions for regional expansion. In sum, despite the persistent trade imbalance favouring China, overall trade has grown, with a notable rise in Colombian exports in 2024 suggesting possible future rebalancing. Chinese Foreign Direct Investment has also increased significantly since 2020, especially in infrastructure and energy. While some in Colombia’s private sector voice concerns about dependency and cheap imports, these criticisms often overlook the opportunities for technological transfer and productivity gains, and misunderstand the cooperative nature of the Belt and Road Initiative.

This article is part one in a series of two.

Tatiana Gélvez-Rubio is Associate Professor at the Faculty of Economics, Universidad Externado de Colombia. PhD in Government from the University of Essex (UK); MSc in International Comparative Studies from the University of Southampton (UK); Economist from Universidad Externado de Colombia. Her research focuses on International Political Economy, Gender and Economics, and the use of statistical and econometric analysis to support public decision-making.

This article is published under a Creative Commons License and may be republished with attribution.