The past few weeks much attention has been paid to the machinations of the Chinese stock market. But it seems likely that there is a long term political strategy in play.

Twenty Five years ago, which was almost yesterday, it was considered somewhat offensive and borderline antagonistic to hand a Chinese businessperson a business card, whilst presenting it with two hands. This was because the Chinese presumed that you had confused them for Japanese – this was, until then, solely their and the Korean’s business étiquette. Such a perceived faux pas ranked highly in the ways a Chinese person could be inadvertently insulted. But somewhere along the journey and the progressive sophistication of Sinosphere mercantilism, this former peccadillo spontaneously inverted and became the expected way of commercial greeting, not only in Japan and Korea but also in the People’s Republic.

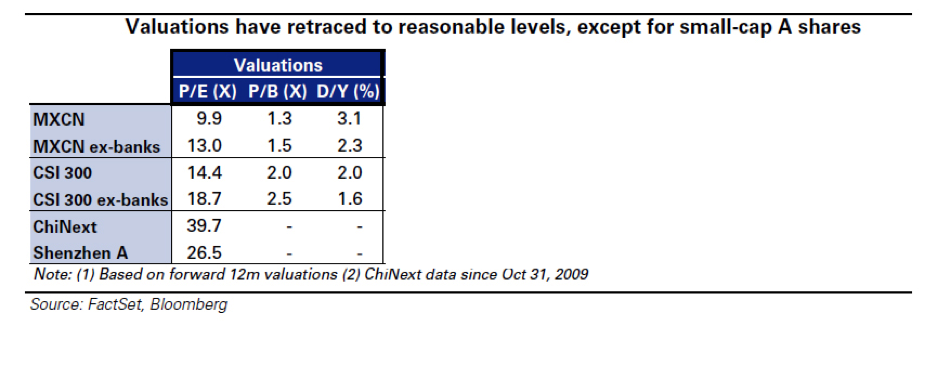

This sea-change highlighted that the Chinese, whom had always presented as proud but equally pragmatic, were willing to adapt and if required, do so quickly, to the changing world around them, if it suited their best long term interests. Accepting that the Chinese enjoy such an innate ability to learn from world’s best practice and absorb the acumen and experience of more experienced hands around them, it is not difficult to better comprehend, what is in fact happening, at this time on stock market bourses such as Mainland Chinese – CSI300, ChiNext, SSE50 – and Proxy – Hong Kong Stock Exchange, NYSE American Depository Receipts (ADRs), NYSE Arca platform synthetic ETFs, et al. Rather than ending, there is a clear-cut case to argue that their listed investment journey has only just begun.

Before presenting the merits of such a thesis, it is first imperative to articulate the following caveat emptor.

Ultimately fundamentals rule the day, however, the experiences since the Great Recession or GFC, have taught us that ‘market moments’ and ‘real economy’ realities do not necessarily walk in lockstep.

Put simply, markets may in the shorter-term move in one direction, whilst it is equally plausible that its respective underlying real economy moves in a contradictory trajectory. Even in less extreme circumstances, a real underlying economy can ‘splutter’ along while its aligned investable markets (whether they be equity, credit, debt, real estate or real asset) roar ahead. The obvious example of this, post the Great Recession is, of course, the United States and its S&P500 bourses.

Why and how such mechanics defy the basic groundings of rudimentary Markets Microstructure Theorem, is a debate for another occasion but the indisputable observation since the nadir of this last significant economic and financial crisis, is that the basic laws of the jungle and clear synergies across quoted markets and real economies, are no longer linear nor even, at times, identifiable.

Whether this reality deserves concern or trepidation is not pertinent for today’s discussion. At this fork in the road, what is important to ascertain is the likely path that China’s investment markets will follow, the implications for Australia’s own investment journey and whether the Mainland Chinese stock market tumult of July 2015 was an extreme example of a bull market in technical retracement or a bear about to slumber.

Before critiquing the effects of these events, their cause must first be clarified, as well as why the Chinese experience has mimicked those seen by experienced hands before them in US, Japanese and Eurozone investment markets.

Stripping out the geopolitics and stereotypical noise surrounding China’s ascent, the basic thesis behind the shift towards domestic equity market investment in China is quite commonsensical.

The Chinese Communist Party’s (CCP) State-led model allowed it’s populous to invest in real estate, so that China could continue its progression from developing to developed economic status during the past fifteen years. The excesses seen within what we refer to as ‘Shadow Banking’ – off balance sheet non-bank lending – were permitted, primarily because this allowed a circuit breaker, when domestic Chinese real estate investing overheated.

Today, the CCP has consciously opened a new gate for its citizenry to invest more easily – contrary to its own rhetoric – into the CSI300 and other Chinese bourses for two primary reasons.

The first is that they now want advanced capital market architectures, just like in the OECD. Second, and more interestingly, they purposely want to inflate their own bourses with very specific outcomes in mind for 2017, 2018 and beyond. These forethought outcomes involve China’s CSI300 index, in the near future, joining the MSCI World Indices, where they are currently and very purposefully not represented. Until very recently, piercing the walls of these ‘iron curtain’ capital controls has been near impossible or at least, not legal. Even though a 9 May 2015 announcement explicitly said that MSCI and the China Securities Regulatory Commission (CSRC) would form a working group to resolve “a few important remaining issues related to market accessibility”, it is very likely the CSRC, on direct instructions from the CCP and more importantly, President Xi, will not budge on these iron curtain controls until the following occurs.

What the CCP wants is an inflation of their stock markets’ valuations and only when this has happened, it would be fair to predict that they then have plans to loosen these capital controls and progressively allow more foreign institutional investors to enter the mainland Chinese bourses. When this happens, CSI300 prices will be far higher than those of today, and these foreign institutional investors will be purchasing Chinese shares with fresh foreign capital, i.e. US Dollars.

Remembering that these Chinese bourses aren’t yet in MSCI World indices, the achievement of IMF “Special Drawing Rights” (SDR) status, sometime soon, will further allow the convertibility of Yuan for US Dollars, even more foreign institutional capital will be, by forced mandate, directed towards the CSI300.

The logic for this is simple.

When China’s bourses are then included in the MSCI World Index or any akin benchmark, a plethora of global institutional passive investment managers, by mandate, must then purchase CSI300 exposures, solely to satisfy their prescriptive portfolio guidelines. The CCP knows this and is making every effort today to stoke bourses like the CSI300 to much higher plains. The above-mentioned MSCI-CSRC working group is well aware of this and the delays have purposely been allowed to continue by the Chinese.

Put simply, the delays will dissipate when the CCP and Xi believe the CSI300 is at valuation levels with which they are comfortable.

Coincidentally, it is the CCP itself – who as a significant stakeholder in a majority of State Owned Enterprises (SOEs) – will benefit when such new price levels are reached. This is not a conspiracy: this is capitalism in practice. The US invented ‘Shadow Banking’ and spent the past six years inflating their own bourses; the British, Swiss, Japanese and now the Eurozone, have followed suit.

Acknowledging that even despite the velocity and volatile nature of the technical retracement during July 2015, the CSI300, for instance, has still ascended by around circa 120% since June 2014.

Framing our thoughts forward and “devil advocating” this thesis, it remains logical to take the position that China’s recent focus upon listed domestic equity markets will result in amplified valuations and subsequent higher stock market prices by 2018 in comparison to today.

Stirling Larkin is a Principal of Larkin Group, an Ultra High Net Worth (UHNW) Wealth Advisor focusing on high yielding global investments and is the Weekend Australian’s “Global Investor” columnist www.larkingroup.com.au. This article can be republished with attribution under a Creative Commons Licence.