India’s recent free trade agreements (FTAs) reflect a strategic shift from defensive trade policy toward a targeted, growth-driven approach. Rather than pursuing agreements for geopolitical signaling or aspirational market access, India has focused on partners where trade complementarities are already strong, logistics are efficient, and economic interests are aligned.

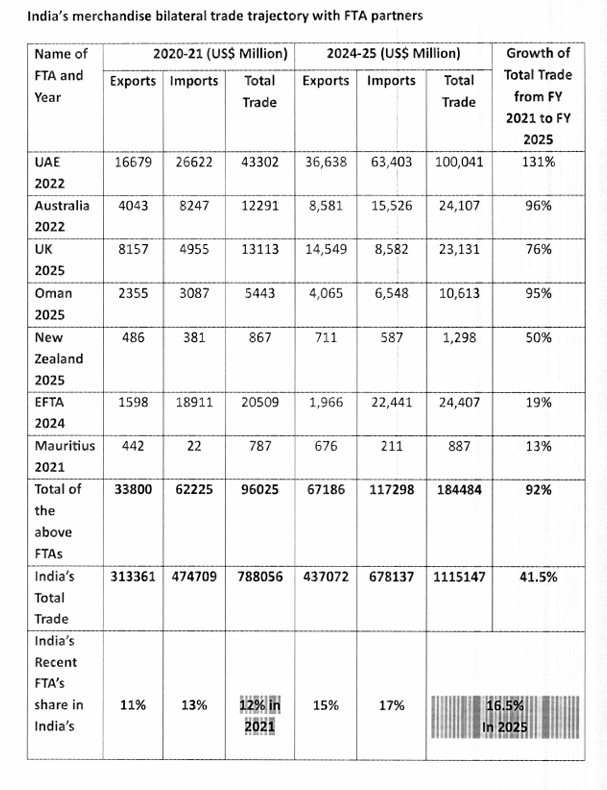

The results are clear: between FY 2020–21 and FY 2024–25, India’s merchandise trade with strategic FTA partners grew by 92%, compared with 41.5% growth in India’s total merchandise trade with the world.

This marks a decisive departure from earlier trade strategies. India is increasingly choosing partners where bilateral trade was already expanding and where agreements can amplify existing momentum rather than attempting to create new trade relationships from scratch. FTAs are thus being used to consolidate and accelerate trade corridors that already demonstrate strong potential.

Between FY 2020–21 and FY 2024–25, India’s total trade with countries covered by FTAs signed since 2021 rose by 92%, far outpacing the 41.5% growth in India’s global trade. The share of these partners in India’s overall trade basket increased from roughly 11–12% in FY 2021 to nearly 16.5% by FY 2025. This shift reflects a deliberate strategy of prioritizing high-intensity, bilateral, trade-oriented economies aligned with India’s strengths in manufacturing, energy processing, pharmaceuticals, services, and investment-led growth.

Importantly, much of this acceleration predates the formal entry into force of FTAs signed in 2024 and 2025. This underscores a key insight: India’s recent FTAs validate existing trade complementarities rather than create them. They serve to lock in, de-risk, and scale trade corridors that proved resilient during the post-pandemic recovery.

Recent FTAs and What Makes Them Work:

Australia: Resources Meet Manufacturing and Medicines

India signed an FTA with Australia in 2022. Since then, bilateral trade has grown rapidly, increasing by 96% between FY 2020–21 and FY 2024–25. Australia supplies coal, critical minerals, metal ores, and energy inputs central to India’s industrial base, while India exports refined petroleum products, pharmaceuticals, machinery, textiles, and consumer goods. The agreement also strengthens services links, particularly in education and professional services, and supports cooperation in clean energy and critical minerals. Strategically, Australia helps India diversify supply chains and secure key resource inputs for long-term growth.

New Zealand: Small Base, Clear Complementarities

India signed an FTA with New Zealand in 2025. Trade has risen by about 50% from a small base, reflecting niche but clear complementarities. India exports pharmaceuticals, machinery, and manufactured goods, while importing wool, agricultural products, metals, and raw materials. The agreement is carefully calibrated, balancing market access with domestic sensitivities, particularly in agriculture, and includes an investment dimension that signals confidence in India’s medium-term growth prospects.

United Kingdom: A High-Value, Services-Rich Partnership

India signed an FTA with the UK in 2025. India–UK trade expanded by 76% between FY 2021 and FY 2025, even before the agreement’s formal conclusion. The UK is a high-income, high-standards market where India competes strongly in pharmaceuticals, textiles, engineering goods, chemicals, auto components, and services. The agreement improves market access, addresses barriers in services and professional mobility, and strengthens investment ties in technology, finance, advanced manufacturing, and clean energy. It reflects India’s confidence in engaging developed markets without undermining domestic policy space.

European Free Trade Association (EFTA): Trade Plus Investment, Not Tariffs Alone

India signed a trade deal with EFTA countries in 2024 . Merchandise trade growth of around 19% understates the agreement’s significance. Imports from EFTA are concentrated in high-value items such as gold, precision instruments, and chemicals, keeping trade volumes stable. The real value lies in embedded investment commitments, technology collaboration, and high-skill job creation. The India–EFTA pact marks a shift from viewing FTAs purely as tariff instruments to using them as vehicles for capital formation and industrial upgrading.

Mauritius: Small Trade Volumes, Large Strategic Value

The India–Mauritius Comprehensive Economic Cooperation and Partnership Agreement functions primarily as a gateway agreement. Anchored in services, investment facilitation, and financial cooperation, it formalises an already close economic relationship. While merchandise trade has grown by about 13% between FY 2021 and FY 2025, the agreement’s importance lies in strengthening regulatory cooperation and institutional “plumbing” for cross-border investment and services.

United Arab Emirates: The Flagship of India’s FTA Strategy

India signed an FTA with the UAE in 2022. Bilateral trade surged from US$43 billion in FY 2021 to over US$100 billion by FY 2025, a 131% expansion in four years. India exports petroleum products, gems and jewelry, machinery, food products, textiles, and manufactured goods, while importing crude oil, petrochemicals, precious metals, and intermediates. The UAE’s role as a global logistics hub amplifies these flows, while strong services and investment linkages reinforce the partnership. This agreement demonstrates how trade intensity, logistics efficiency, and sectoral alignment can deliver scale and resilience.

Oman: Energy, Logistics, and Proximity

India signed an FTA with Oman in 2025, with bilateral trade rising by 95% over four years. The relationship is anchored in energy imports, food products, machinery, metals, and logistics services. Geographic proximity and historical commercial ties give this corridor inherent strength, and the comprehensive nature of the agreement consolidates a trade trajectory that was already moving decisively upward.

Conclusion: FTAs as Accelerators, Not Experiments

India’s recent FTAs are not speculative exercises. They are anchored in trade corridors that were already expanding rapidly during the post-COVID recovery. The 92% growth in trade with these partners—more than double India’s global trade growth—shows that India is signing agreements where complementarities are real, logistics are efficient, and economic interests are aligned.

As tariff commitments deepen, services provisions mature, and investment pipelines translate into capacity creation, India’s trade with FTAs signed since 2021 is expected to more than double again by 2030. In a fragmented global trade environment, India’s strategy of signing FTAs where trade already flourishes may prove to be its most resilient and economically sound breakthrough.

Anna Mahjar-Barducci is a Project Director at the Middle East Media Research Institute (MEMRI). She has also contributed to think tanks and academic institutions such as TRENDS (UAE). She is currently a columnist for the Italian daily La Ragione. Mahjar-Barducci lectured at the U.S. State Department and has been part of several U.S. State Department-sponsored events through the Middle East Partnership Initiative (MEPI). She also worked as a researcher in South Asia, Tunisia, Senegal, and Zimbabwe.

This article is published under a Creative Commons License and may be republished with attribution.