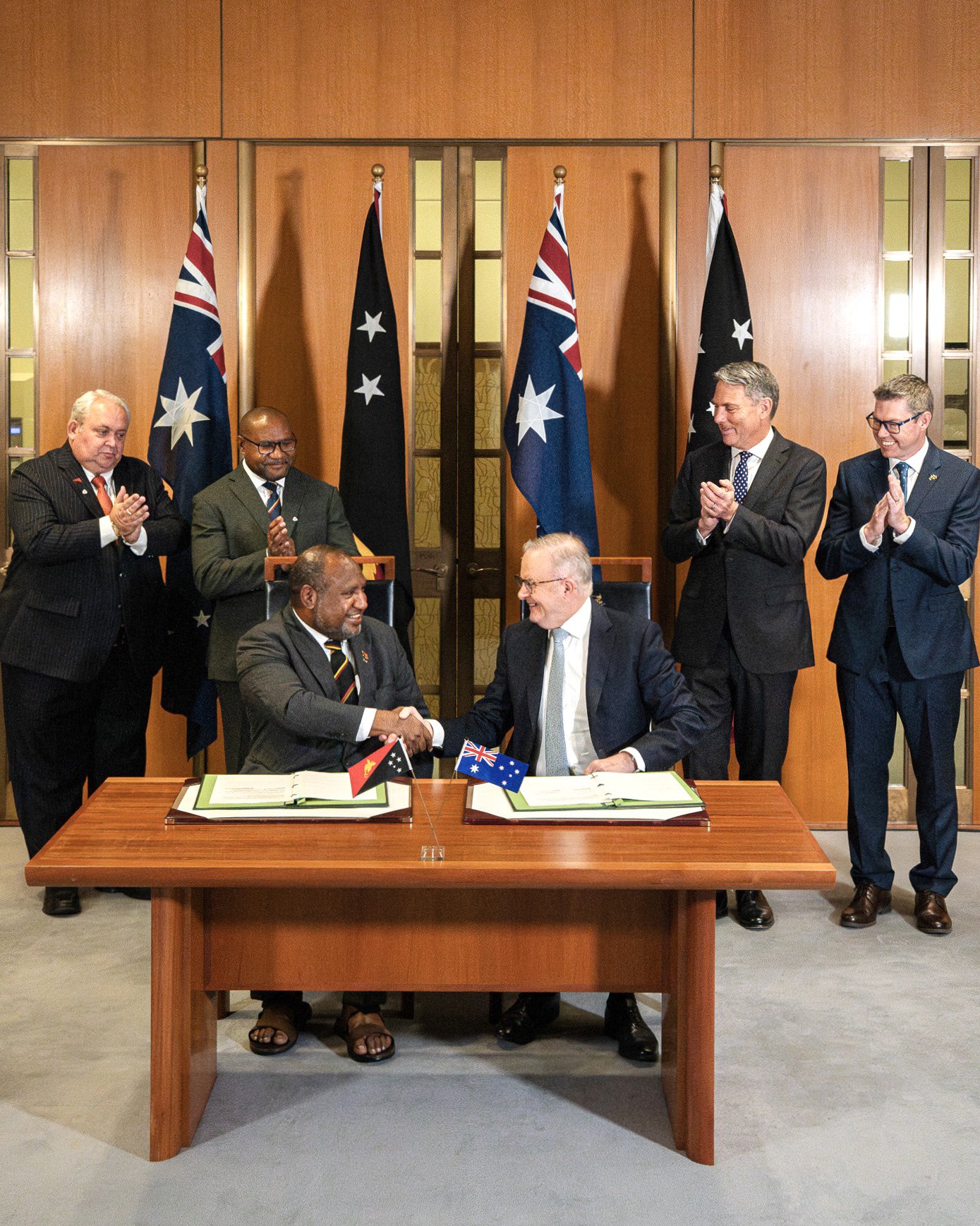

President Trump’s meeting with Prime Minister Anthony Albanese marked an important next step in building a more resilient Australia–US relationship. On October 20, the two signed a major US $8.5 billion critical and rare earth mineral deal, inaugurating a critical next phase in bilateral ties. AUKUS has already laid the foundation for a deeper defense partnership, but this new deal must expand that partnership into the industrial and economic arena.

The challenge now is to strengthen the bilateral base of critical mineral supply chains—linking extraction, processing, and advanced manufacturing into a system that supports defense production and national resilience. This will be a crucial step in reducing long term dependency on Chinese critical minerals and help create a more durable, partner-integrated supply that secures the materials necessary to build the defense capabilities Australia wants supplied.

Building an Alternative Supply Chain

China currently dominates the global market by controlling most of the world’s refining capacity and a large share of global reserves. Additionally, it is aggressively investing in acquiring stakes in international critical mineral industries. The US, by contrast, is heavily reliant on global imports of critical minerals, many of which are only accessible in China. Beijing has used mineral export restrictions against the US to push back on American export controls of microchips to Chinese technology companies.

Beijing’s control over antimony, an essential component in defense manufacturing, semiconductors, and advanced energy storage, is an important example. China controls nearly 80 percent of global antimony production and dominates refining capacity, making it the decisive gate-keeper. The United States is almost entirely import-dependent for its antimony supply. Recent Chinese export restrictions and port detentions—including an August incident in which an Australian shipment of antimony bound for a US defense contractor was blocked from leaving China’s Ningbo port—exposed how vulnerable Washington’s supply chains remain to coercion.

China’s restrictions have pushed the US to finally move to reduce its reliance, capitalise on global partnerships, and build alternatives to Beijing. This has prompted a global search for partners and gives Australia a rare opening. US-China competition extends from the base of the supply chain and encompasses everything from extraction, processing, and refining of critical minerals and downstream industries like semiconductors and batteries. Australia, a key US partner, hosts significant untapped antimony reserves in areas like Queensland, New South Wales, and Western Australia. With strategic investment, these deposits could anchor a secure, non-Chinese supply corridor critical to US defense and energy industries.

For the US, the challenge is building a parallel supply chain that can sustain defense production and technological growth independent of Beijing’s grip. Australia sits at the center of that equation. It already supplies nearly half of the world’s lithium and ranks among the leading producers of cobalt, manganese, rare earths, zircon, and tantalum, while holding vast undeveloped reserves of cobalt, vanadium, and tungsten. These are precisely the resources the United States and the United Kingdom need to reinforce industrial resilience. Backed by its 2030 Critical Minerals Strategy and a A$4 billion co-finance facility, Australia is positioning itself for a shift from raw exports to expand its expertise in refining and midstream processing, including by deepening cooperation with other midstream players, like the United Arab Emirates. This lays the backbone for a secure, allied supply chain.

Framing a future partnership

The October 20 agreement between Trump and Albanese should serve as the blueprint for how Australia and the United States can translate shared strategic intent into an industrial reality. The rare-earths pact is signed, but the task ahead is execution. The commitments on paper need to be bound in a durable, long-term framework that integrates investment, processing, and production across both economies.

Under the new agreement, both nations will provide at least $1 billion in financing for projects located in the United States and Australia within the first six months. If implemented effectively, this funding could streamline industrial co-production through joint investment in refining hubs, secure long-term offtake agreements, and develop shared infrastructure that bypasses Chinese chokepoints. This injects the speed, capital, and accountability needed to scale critical-minerals coordination. Closing the gap with China, however, will take years, not months.

Second, both sides will work to limit China’s investment reach into third countries through coordinated investment screening and diplomatic engagement. The United States already maintains a robust screening regime that can be adapted to flag and prioritize critical-mineral transactions, but the harder task lies abroad. Convincing mineral-rich countries in Africa and Asia—many of which rely on Chinese capital—to turn down Beijing’s financing will require a credible alternative, not just pressure. If the US–Australia framework fails to create meaningful space for third countries, including those with refining capacity or untapped reserves, the plan will struggle to compete with China’s established financing networks and political influence.

Third, the deal lays the groundwork for a broader international framework to manage price volatility stemming from China’s dominance of global supply. Beijing showed its willingness to use export controls to weaponize access to critical minerals as leverage in its trade competition with the US. Both Washington and Canberra will need to hedge against the resulting price shocks by coordinating reserves, market stabilization tools, and transparent pricing mechanisms that reduce vulnerability to Chinese manipulation of supply. Both nations will need to transform this framework into an international set of norms, but that requires multilateral buy-in from other major players across the supply chain. Trump’s ongoing trade policies with his many international partners could make this difficult.

Building AUKUS amidst escalation

Building on the AUKUS framework gives this new phase an institutional backbone. AUKUS has already opened Australia to the world’s largest defense markets and removed barriers for sensitive technology trade, allowing over 200 Australian firms to join allied supply chains. Canberra’s A$262 million Industry Uplift Fund and A$19 million supplier-qualification program are expanding that base by preparing companies to contribute to both submarine and other advanced manufacturing sectors. These shifts will integrate Australia further and expand its role in U.S. production networks.

The systems Australia wants to acquire under AUKUS demands a wide range of embedded critical and rare earth minerals. A modern U.S. nuclear-powered submarine—the type US and Australia intend to co-build—may require around 4.5 tons of rare-earth and other critical minerals alone. These materials feed everything, from electric motors and guidance systems to sensors and batteries. The US has neither the secure supply nor the processing capacity to meet that demand independently. Australia’s resources provide a viable alternative.

Chinese officials will likely view the US–Australia deal as an escalation in the broader trade and technology competition, but their deeper concern will be Trump’s “full steam ahead” endorsement of AUKUS and the commitment to deliver nuclear submarines to Canberra. This announcement coincides with the opening of the CCP’s Fourth Plenary Session, which puts pressure on President Xi to project strength and signal that Beijing will not allow its strategic influence in the Indo-Pacific to erode unchallenged.

Jesse Marks is the CEO of Rihla Research & Advisory LLC, an international geopolitical consultancy focused on the Middle East and Asia.

This article is published under a Creative Commons License and may be republished with attribution.