Troubled Times for the World Economy

Although current economic developments pose a great challenge for Australia, they also present the opportunity for renewed international leadership.

As the old joke has it, I’ve predicted five of the last two recessions. Someone with my temperament and track record is possibly not the best person to ask about the prospects for the world economy. But then, who is?

Professional economists are famously poor at predicting what’s going to happen in their supposed area of expertise. At least I’m in good company now: no less an authority than the International Monetary Fund is warning that it may be hard to avoid another Great Depression. Given that the IMF missed the 1997 Asian Financial Crisis and the – rather misnamed – 2008 Global Financial Crisis, perhaps we shouldn’t fret too much.

On the other hand, comparisons with the Great Depression are looking more plausible by the day. Unfortunately, it is not only skittish financial markets, poorly-regulated banks and rampant speculation that looks worryingly like the 1920s; the international political environment isn’t looking too bright either.

Troubled times tend to generate troubling leaders. The rise of Erdogan, Putin, Modi and a clutch of established or aspiring despots in the Middle East, Latin America and Africa mean that democracy and the much-invoked rules-based international order are looking more fragile by the day.

This combination of events would be bad at any time. But when the current ‘leader of the free world’ is completely disdainful of multilateral cooperation and thinks of international economics in terms of zero-sum games, then it is hard to see who is going to provide the sort of leadership that many think is a prerequisite of economic stability and growth.

Even Donald Trump’s admirers – and, yes, there are some and not just in the backblocks of America – would have to concede that history is not his strong suit. The probability that he might be aware of the ‘lessons’ supposedly learned from the Great Depression – and which led directly to the creation of the so-called Bretton Woods institutions – is not high.

The fact that Trump is increasingly surrounded by sycophants or mavericks like his trade advisor Peter Navarro – as well as the noteworthy absence of the supposed ‘adults’ who were going to keep him in line – doesn’t inspire confidence in the US playing a constructive role in warding off the catastrophe the IMF fears.

And it’s not just the international economic and political system that is being roiled by the actions of President Trump. On the contrary, there has been an epidemic of books about the crisis of democracy in America itself as domestic politics becomes increasingly polarised, partisan and toxic.

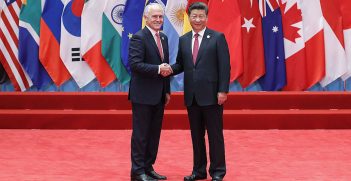

Those hoping that China will assume the leadership mantle seemingly cast aside by the US are likely to be disappointed. There is no sign that China has the political will or capacity to provide some of the ‘collective goods’ many consider necessary to keep the international economy functioning. A fully tradeable currency and an open domestic economy are not priorities for China at a time when its economy is looking increasingly wobbly.

It is important to remember that an economic crisis in China would very likely rapidly become a political crisis. After all, now that Xi Jinping is ‘chairman of everything’, he’s also responsible for everything. Many Chinese investors cling to the belief that the government is unambiguously in charge and wouldn’t let anything happen to their savings. Quite how they and the leadership cope with an unambiguously capitalist crisis in the People’s Republic will be interesting to see.

It will also be profoundly important for Australia. Australia is famously and – from a public policy perspective – inconveniently dependent on ‘communist’ China for its economic well-being these days. Even the dimmest backbencher now realises that we can’t gratuitously offend the Chinese Government. The other seemingly self-evident truth embraced by most of our political class is that we can’t afford to upset the Americans either, even if their leader is currently the greatest danger to the international system upon which Australia’s prosperity depends.

But don’t expect too much pushback from Australia’s leaders, despite the direct threat to the ‘national interest’. Scott Morrison recently suggested that Trump’s “rather unconventional approach” to trade policy might be driven by an understandable frustration with business as usual. That doesn’t make it right, though. The reality is that the current generation of political leaders can think of nothing better than keeping their heads down and hoping it will all blow over.

Although some of the comparative commentary about the ‘golden era’ of policy making under Bob Hawke is a bit overdone, it did manage to produce at least one example of effective middle-power diplomacy. The Cairns Group of agricultural exporting nations actually helped to keep the international trade system relatively open and liberal when the great powers were becoming more protectionist. Is it too fanciful to think that something similar might be possible again?

For all the frequent rhetoric about the merits of middle power diplomacy, it is seldom seen in practice. The late 1980s suggests that such things are actually possible, at least with a little vision and self-confidence. When the great powers are clearly failing to lead by example, alternative ideas and leadership ought to be welcomed and embraced, even by the Nervous Nellies who pass for our political leaders.

Mark Beeson is Professor of Political Science and International Relations at the University of Western Australia and the AIIA National Research Chair. He was a speaker at the AIIA National Conference on 15 October.

This article is published under a Creative Commons Licence and may be republished with attribution.