G20: South-South Investment for Global Growth

As China prepares to host the G20 leaders’ summit in Hangzhou, the most high-profile meeting of world leaders in the country’s history, global growth is stagnating. However, this summit stands as a critical moment for the private sector to accelerate equitable development. The policy approaches taken by the G20 nations—both emerging and advanced economies—can create a win-win not only for North and South but for South-South investment and, in turn, the global economy.

Following July’s shock Brexit vote, the International Monetary Fund (IMF) trimmed its global forecast from 3.5 to 3.4 per cent for 2017.

This makes it harder for the 200 million people in the human family who are currently excluded from economic life and looking to participate in the dignity of work. At the same time it throws the spotlight on the urgent need for low and middle-income countries to redirect their economies towards new sources of growth, tap investment from other low- and middle-income countries—the essence of South-South—and make this investment more effective.

At the recent T20 Summit in Beijing—the think-tank arm of the G20 designed to support the group’s policy outcomes—I joined other policy makers and practitioners in a discussion around South-South investment with all of us conscious of its potential to be a force multiplier for development impact. It is a bright spot of growth generation for the troubled and volatile world economy.

All of us should be encouraged by the dynamism of the South, which is reflected in the growing phenomenon of South-South investments that are changing the landscape of international investment flows.

Today foreign direct investment (FDI) is a key source of financing for low- and middle-income countries. Beyond capital, the value generated for destination countries and companies is derived from access to technology, expertise, better environmental, social and governance standards, new product offerings at lower costs and successful business models.

For source countries and companies the value from South-South investment manifests itself not only through the tapping of new markets for growth, but also diversification of risk, accessing local resources, knowledge and skills, and a reduction in costs through a more efficient allocation of resources.

For both source and destination countries, there are also gains to be made through increased growth, job creation and better regional and financial integration.

Since 2004, South-South investment has been a priority for the International Finance Corporation (IFC), the private sector arm of the World Bank Group. From the IFC’s experience, when companies of the South are linked to the global economy and use innovative business models developed in one emerging market and then replicate them in a recipient South country, these models and technologies are often more easily absorbed and better attuned to the needs and economic and institutional conditions than those investments from more advanced markets. When investors come from similar environments and are familiar with the operating environment, they can take on more risk.

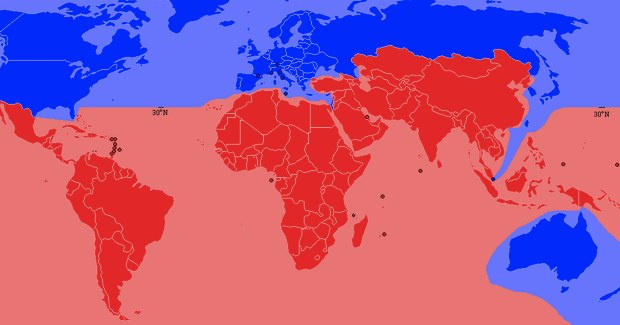

Emerging markets have become an increasingly important source of investment. According to the 2015 UNCTAD World Investment Report, investments by multinational enterprises located in emerging markets reached a record level in 2014. Although developed markets continue to be the largest source of foreign direct investment, between 2003 and 2015, the share of emerging markets has doubled in both percentage terms from 16 per cent to 33 per cent, and in absolute terms, from US$111 billion to US$236 billion (A$147 billion to A$313 billion). During the past five years alone, FDI flows from emerging markets to other emerging markets have totalled US$816 billion.

What these figures reveal is that while investment rates in and between South countries have been good, they are not enough. Against the backdrop of sluggish global growth, low- and middle-income countries need to be the next engine room of such growth. This underscores the need for spreading and sustaining rapid expansion of South-South investment that is more effective in pursuit of lasting development gains, fosters more and better innovation and unleashes entrepreneurial energy. When entrepreneurial energy is set free it helps drive innovation which helps drive long term growth.

FDI is a crucial way through which the facilitation of the sharing of technology can occur, enabling access to new markets, new growth and new jobs that emanate from innovative, game-changing products and services. For low- and middle-income countries to make best use of technology transfer and its dissemination they require proactive and coherent policy support. This highlights the vital role governments play in allowing businesses to leverage FDI effectively as a means to achieve technology transfer.

This also underscores the need for greater efforts to remove unnecessary barriers to FDI and promote long-term investment. While some low and middle income countries have benefited already from South-South investment, there is so much more potential waiting to be unleashed. Some South countries are still only beginning to enjoy its benefits, while others are waiting to reap the full benefits offered by increased investment.

This is where the G-20 leadership is vital, not least because this body represents all corners of the globe; in terms of its economic might, member states of the G20 account for around 85 per cent of global production and nearly 80 per cent of global trade. The policy actions and approaches, therefore, of G20 nations—including both emerging and advanced economies—can create a win-win, not only for North and South, but also South-South and, in turn, the global economy.

Let us not forget that an economic order that excludes so many millions from progress and basic human dignity is not only unjust, it is a profound economic and security risk. This G20 stands as another critical moment for the private sector to accelerate equitable development.

When the story of this G20 gets written, we want it to say that business and government, together with the multilateral system and other actors did all that they could, and took the hard decisions needed to set our world on a fairer and more sustainable path.

The poor and future generations are owed nothing less.

Daniel Street is a strategist for the International Finance Corporation (IFC) covering East Asia Pacific and represented the IFC at the T20 Summit in July in Beijing. This article is published under a Creative Commons Licence and may be republished with attribution.