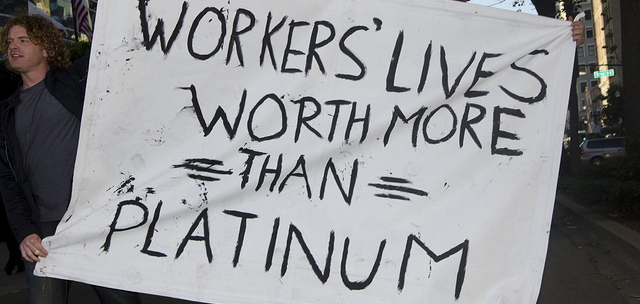

South Africa: One Strike Ends, Another Begins

The five-month long platinum minersʼ strike, the longest and costliest in South African history, has ended. A new strike, however, that began on 1 July, is likely to further weaken the beleaguered economy.

Background

The Association of Mineworkers and Construction Union (AMCU) agreed to a wages deal with Lonmin, Impala Platinum and Anglo American Platinum on 23 June, bringing to an end the five-month dispute. The deal, which applies only to AMCU members, will see the lowest-paid workers receive an increase of 1,000 rand ($100) per month over the next three years. Staff will also receive other benefits, such as a pension, housing and health insurance. Unfortunately, the deal does not mark the end of labour disputes, as the countryʼs second-largest trade union announced that a majority of its members would stop work from 1 July.

Comment

Five months of strikes have taken an enormous toll upon the national economy and particularly the platinum industry. The South African economy contracted by 0.6% in the first quarter of 2014, partly because of the labour disputes. Affected companies claim that the strikes have cost them more than 24 billion rand ($2.39 billion). The 70,000 striking workers fared no better, losing 10.6 billion rand ($1bn) in wages. The wage increases are projected to add one billion rand ($99.7m) to the operating costs of platinum producers.

Even though the AMCU strike is now over, recovery will still take time. Since South Africa may be facing the prospect of two consecutive quarters of negative growth, there are growing fears that a recession may be imminent. Platinum production is not expected to return to pre-strike levels for at least the next three months. In a further blow to economic growth, South Africa faces rolling power blackouts, due to electricity shortages. The countryʼs Reserve Bank also attributes the negative first quarter growth to the lacklustre electricity supply. As a result of both factors, the manufacturing sector is also considerably weaker, compared to the fourth quarter of 2013.

There is growing concern that other unions will follow the lead of AMCU and down tools. South Africa is entering the period of the year known as “strike season”, when unions traditionally enter wage negotiations. Already, the National Union of Metalworkers of South Africa (NUMSA), the largest union in South Africa, has announced that up to 220,000 of its 330,000 members would strike from 1 July, demanding a 12% increase in wages. The strike will affect the automotive components, engineering and communications industries and is likely to have a detrimental impact upon the already strained economy.

There are fears that, if the NUMSA strike is not quickly resolved, it could also have a negative impact on the state-owned power utility, Eskom. There are 11,000 members of the union working at Eskom, who are legally not permitted to go on strike because they provide essential services. Any work stoppage at Eskom, which supplies 95% of South Africaʼs electricity, will affect all economic sectors. The strike could not come at a worse time for Eskom, which is already several months behind schedule on the construction of new power plants.

With the signing of a wage deal between the AMCU and international platinum producers, one of the causes of economic contraction in South Africa has been ameliorated. The failure to meet the demand for electricity remains, however, and a new round of strike activity is likely to make this a continuing problem. While the second quarter may show some improvement in the national economy, it is too soon to tell whether the protracted mining strike has led to a recession. Even if it avoids an economic contraction in the current quarter,continuing labour unrest does not bode well for future economic growth or the level of foreign investment in South Africa.

Mervyn Piesse is a research assistant at the Indian Ocean Research Programme.

This article was originally published by Future Directions International. It is republished with permission.